Historic mine, modern technology and future hedges: the Wingdam gold project

Building on the promise of historical data, Omineca Mining is using innovative technology to recover gold in the Cariboo

In 1622, the Spanish ship Nuestra Señora de Atocha sank in approximately 16 metres of water off the coast of the Florida Keys, taking with it an almost priceless cache of copper, silver, gold and gems. For more than 350 years, divers and treasure hunters knew of the shipwreck and tried to recover the riches, but it wasn’t possible until 1985, when diving technology advanced enough to allow Mel Fisher and a team of salvagers to locate and access the wreck—and the sunken treasure.

I told you that story to tell you this one.

Tim Termuende, president and CEO of Omineca Mining and Metals Ltd. (TSX: OMM), compares the Wingdam Mine and the century-plus quest for its gold to a sunken galleon with untold riches that everyone knows is there but no one has ever been able to claim. That, in part, is what makes the project so exciting.

The Wingdam Mine is located about 40 kilometres from the mining town of Barkerville in the historic Cariboo gold district in British Columbia. This was an area of significant exploration during the gold rush of 1861: over 73.7 million grams (2.6 million ounces) of gold have been reported by placer miners in the district, with the actual totals likely much higher. Wingdam’s gold lies atop the bedrock in a deep channel 50 metres beneath Lightning Creek, one of the most prolific placer-mining creeks in the Cariboo.

The initial attempts at a dive

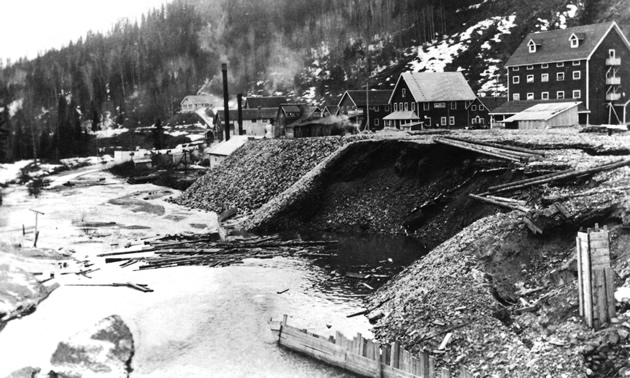

The first company to try to access the buried treasure was the Lightning Creek Gold, Gravels & Drainage Company; in 1896, the company attempted to drive a drift about 2.4 kilometres downstream of the current Wingdam site—an initiative that was abandoned when, in the early 1900s, flooding and timber support failure caused the collapse of the drift first and the company’s finances second. Next up, Lightning Creek Gold Mines Ltd. (later the Consolidated Gold and Alluvials of British Columbia) conducted extensive drilling to define the location of the channel and establish grades. The goal was to use the Australian deep-lead mining method in order to drift from the bedrock into the pay gravels in the channel below the creek. During this time, the village of Wingdam was established near the mine’s shaft works in the ‘30s—complete with a local baseball team fittingly named the Wingdam Moles—and all looked well until a massive cave-in in March of 1938 brought the enterprise to a halt.

The works sat idle until 1961 when the Wingdam & Lightning Creek Mining Co. Ltd. pumped out the shafts, extended the workings downstream and began mine development work in 1964. The company reported sampling that indicated that “values average out to over $6 million per mile” (approximately $470 million per kilometre at today’s prices). Alas, the success was short-lived as yet another cave-in ended operations altogether for more than two decades. In the meantime, more bad fortune beset the site: a fire in the 1970s decimated the shaft works and virtually eliminated the last reminders of the town of Wingdam. In a century of sporadically successful production, only 58,000 grams of gold (1,700 ounces) had been recovered.

Interest is reawakened

The works sat dormant until 1992, when Gold Ridge Resources Ltd. used more modern technology, hydraulically jacking a 1.06-metre pipe out into the channel from the bedrock rim to access the pay gravel. Unfortunately, the company's aim was slightly off; the pipe ended up sitting just above the gold. Finances dropped, equipment failed and once again the mine closed. There were a few more sniffs from other operators, but the mine was dormant until 2009 when CVG Mining Ltd. took over the property and set to work compiling historic data and testing the property. In 2012, Omineca announced a reverse takeover (RTO) of CVG, with the Wingdam as the primary asset.

That brings us to today.

Termuende and Leonard Sinclair, the president and CEO of CVG, are confident that mining technology has evolved to the point where the sunken treasure at Wingdam can finally be recovered (Sinclair is staying on as project manager). They are borrowing the same technology that potash mines in Saskatchewan use to sink massive shafts through the Blairmore Foundation of wet clay and sand. At Wingdam, a test-mining operation completed by CVG used freeze-mining technology to stabilize the unconsolidated gravels and provided CVG with the ability to drive a production drift across the pay channel at depth. Termuende said that CVG's test-mining resulted in a bulk sample that recovered 99 per cent of the gold and confirmed both the freeze-mining process and the results of historic sampling and limited production.

“These are historically very high grades,” said Termuende, “the kinds of grades they were getting in the original rush of the 1860s. You don’t get those anymore—and those extreme high grades are still intact at Wingdam.”

Sinclair also believes that the timing is on their side this time.

“The exciting part of this test-mining project was the opportunity to overcome the history of failures that had surrounded the project for about 116 years,” said Sinclair. “Of course, it is gratifying to think that we overcame significant issues that may have stopped others . . . Anyone who has lived with a project knows that certain factors need to be in place to be successful; fortunately, the factors of good financing, a good lawyer, a good accountant, good consultants, a hard-working crew, a bit of luck—and the support of my wife—came together to make this project what it is.”

When you do the math

The official reporting on the reserves is yet to be completed, but Termuende said the economics of the project are potentially very robust—and the math is intriguing: the CVG tunnel, which was approximately 2.4 metres in width and 23 metres in length, yielded 4,704 grams (173 ounces) of gold; if this holds true for the two-plus kilometres of unmined stream channel, the yields could be around 4.2 million to 5.6 million grams. Buried treasure, indeed.

What makes this project even more appealing are the bottom-line figures. It has very affordable startup costs of approximately $10 million, and no milling, leaching or tailings facilities are needed. Recoveries are approximately 99 per cent, and the operation can run year round. A placer-mining permit is already in place and is currently being amended to accommodate freeze-mining production. Investors are showing keen interest in the project. Termuende believes that even in a very challenging market—and with gold’s recent nosedive—the project will pan out.

“I firmly believe in the rising price of gold,” said Termuende with a grin. “The great thing is that we can wait until the price of gold is right and markets are supportive to begin operations, since it is essentially a turnkey operation. It can sit idle until the conditions are right. It’s really an incredible hedge on gold in the future.”